Thats WACC!

<p>Cash is not free; and a cash investment is not always cheaper than a loan.</p>

<p>The cost of money – known as the Weighted Average Cost of Capital (WACC) – tells you the cost of the cash that is currently in your bank account. The money in your bank account may have come from your company’s profits, but those profits came at a steep price. You may have spent money on marketing, operations, or overhead; some of the money you spent may have come from a loan, line of credit, an investor, or maybe even your personal savings. So, how do you know how much that cash costs?</p>

Read moreHow Financing Could Solve Climate Change

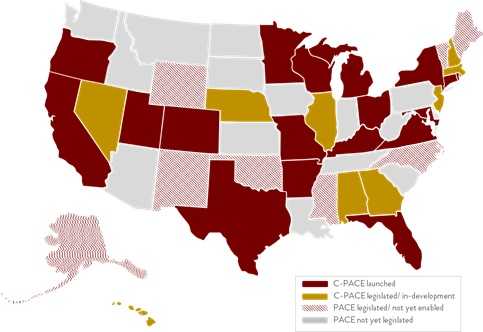

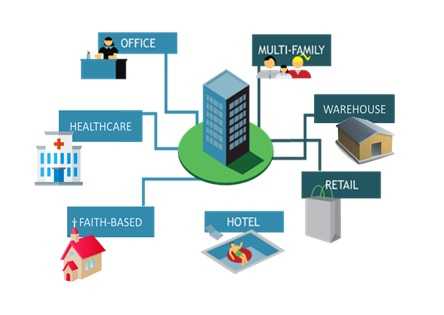

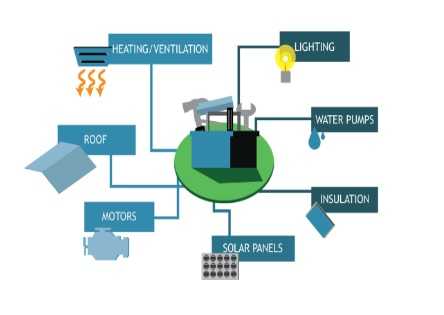

<p>An innovation is quietly taking hold and it is on track to make today’s environmental design best practices the status quo before the end of the decade. Already, many of the nation’s largest property owners are using it to retrofit entire portfolios, while major developers are including it in all new construction. Universities are promoting it; think tanks are validating it; and business magazines singing its praises. Available in over 37 states, it can be used to replace old appliances just as easily as it can be used to install rooftop solar. It’s called Property Assessed Clean Energy, or PACE; and while you’ve probably seen it in the headlines, chances are that it’s not what you think it is.</p>

<p>PACE is a novel way to improve America’s building stock. For projects that don’t guarantee energy savings PACE transforms the standard ROI model based on payback periods into a question of cash flows. By offering borrowers long enough terms to ensure that the annual repayments are always less than the annual utility savings, PACE projects should always be cash flow positive within the first year after construction completion.</p>

<p>However, PACE isn’t a “source” of funds, per se. It’s a mechanism, through which funds are transferred from a capital provider to a government agency to a building and then repaid. This transfer process changes the accounting treatment of the funding, greatly improving a project’s economics while simultaneously aligning the ongoing utility savings with the upfront costs of the improvements. In essence, PACE is the first scalable solution to one of the great obstacles to environmental best practice in commercial real estate: the split incentive.</p>

<h2>Solving Problems with Taxes</h2>

<div class="up-articles__content__image up-articles__content__image--left" style="width: 370px">

<span class="gatsby-resp-image-wrapper" style="position: relative; display: block; margin-left: auto; margin-right: auto; max-width: 444px;">

<a class="gatsby-resp-image-link" href="/static/20fec51739ff58c72a446d8837ee75e6/93c72/solving-problems.jpg" style="display: block" target="_blank" rel="noopener">

<span class="gatsby-resp-image-background-image" style="padding-bottom: 70.94594594594594%; position: relative; bottom: 0; left: 0; background-image: url('data:image/jpeg;base64,/9j/2wBDABALDA4MChAODQ4SERATGCgaGBYWGDEjJR0oOjM9PDkzODdASFxOQERXRTc4UG1RV19iZ2hnPk1xeXBkeFxlZ2P/2wBDARESEhgVGC8aGi9jQjhCY2NjY2NjY2NjY2NjY2NjY2NjY2NjY2NjY2NjY2NjY2NjY2NjY2NjY2NjY2NjY2NjY2P/wgARCAAOABQDASIAAhEBAxEB/8QAFwABAQEBAAAAAAAAAAAAAAAAAAECBf/EABUBAQEAAAAAAAAAAAAAAAAAAAAB/9oADAMBAAIQAxAAAAHuyE2F/8QAFxABAQEBAAAAAAAAAAAAAAAAAAERIf/aAAgBAQABBQKOosZUf//EABQRAQAAAAAAAAAAAAAAAAAAABD/2gAIAQMBAT8BP//EABQRAQAAAAAAAAAAAAAAAAAAABD/2gAIAQIBAT8BP//EABYQAAMAAAAAAAAAAAAAAAAAABAgMf/aAAgBAQAGPwJKP//EABkQAAMBAQEAAAAAAAAAAAAAAAABESFBUf/aAAgBAQABPyFh7fhU0bxkeCpp/9oADAMBAAIAAwAAABC3z//EABQRAQAAAAAAAAAAAAAAAAAAABD/2gAIAQMBAT8QP//EABQRAQAAAAAAAAAAAAAAAAAAABD/2gAIAQIBAT8QP//EABsQAAICAwEAAAAAAAAAAAAAAAERACFBYXGx/9oACAEBAAE/EHgs2z6oBKKarnQgLUBvrgDKJeRuWKt4n//Z'); background-size: cover; display: block;"></span>

<img class="gatsby-resp-image-image" alt="Solving Problems with Taxes" title="Solving Problems with Taxes" src="/static/20fec51739ff58c72a446d8837ee75e6/93c72/solving-problems.jpg" srcset="/static/20fec51739ff58c72a446d8837ee75e6/40f63/solving-problems.jpg 225w,

/static/20fec51739ff58c72a446d8837ee75e6/93c72/solving-problems.jpg 444w" sizes="(max-width: 444px) 100vw, 444px" loading="lazy">

</a>

</span>

</div>

<p>In energy services parlance, split incentive refers to a standard clause in most net leases that obligate a tenant to pay for utility costs and a landlord to pay for building upgrades. Intuitively, this clause may make sense. After all, tenants use the utilities and upgrades increase the value of the landlord’s building. Except that most landlords own their buildings for a long time, often beyond the useful life of the upgrade; thus, they rarely collect a return on the added asset value. In fact, a building owner, keeping all the costs and giving away all the energy savings, may never see a positive return on the investment.</p>

<p>Therefore, it should be of no surprise that Lawrence Berkeley National Lab’s 2013 “Remaining Market Potential of the U.S. Energy Services Company Industry” found that commercial buildings only achieved a 10% adoption rate of energy efficiency technologies. Consequently, this sector of the economy accounts for a whopping 40% of energy consumption in the U.S. and is the largest source of carbon reduction potential in the country.</p>

<p>The power of PACE that solves the split-incentive paradox is its ability to convert project financing to property tax assessment financing, triggering an accounting treatment transformation with deep ramifications. While funds provided to the building must be repaid, the repayment obligation is treated as a property tax. Under most commercial leases, tenants pay the property tax either as a part of the rent or as a separate charge, placing them with de facto responsibility for repaying the cost of the project; thereby, closing the split-incentive gap.</p>

<p>What this means for commercial building owners is that they can access low-cost, private sector capital to pay for 100% of eligible projects, finance the cost of the project over time to ensure that the annual payments are less than the annual utility savings, and avoid split-incentive. The building is improved without any capital expenditure and operating expenses are reduced for either the tenant or the landlord – whoever is responsible for paying property taxes and utilities.</p>

<p>There is no catch; no fine print. This simple, yet eloquent mechanism called tax assessment financing currently funds public service projects – from new sidewalks to street lamps – in over 37,000 jurisdictions across America and has been doing so since 1736, when Benjamin Franklin proposed the idea to pay for a Philadelphia fire department. The novelty of PACE is that it is the nation’s first voluntary property tax-assessment, and it can be applied to individual buildings.</p>

<h2>Disrupting Commercial Real Estate</h2>

<div class="up-articles__content__image up-articles__content__image--right" style="width: 370px">

<span class="gatsby-resp-image-wrapper" style="position: relative; display: block; margin-left: auto; margin-right: auto; max-width: 598px;">

<a class="gatsby-resp-image-link" href="/static/a9e8d0e4bdcf5aee4aa81d24b0312efc/16bf3/commercial-real-estate.png" style="display: block" target="_blank" rel="noopener">

<span class="gatsby-resp-image-background-image" style="padding-bottom: 112.20735785953178%; position: relative; bottom: 0; left: 0; background-image: url('data:image/png;base64,iVBORw0KGgoAAAANSUhEUgAAABQAAAAWCAYAAADAQbwGAAAACXBIWXMAABcRAAAXEQHKJvM/AAADmUlEQVQ4y6VUa0hTYRj+dsmdM3c2L5VmaSObbpVhGIKjmhFEYnbR6ZxUi5CIoiKiH/0okP4ERQYzwx9CMKKiP5ndyNxwrkxND1S2mR1veXY5dBPE0sLT+33psLxVfvDwvTvf+z573u95z0HFxcWMxWJJAqhGR0fpjo6O6M7OTs3f4a3G9+ZVFBcYYThhSP2mvUmOgIgGLAJQoihKWJaVQ/Lc8Pnk3pfN8q9Q03wtP7apvDAGzXddGN+dtpS8x6alvwhBWRigELW1tSFQMCu8r1nkObOZ1LtPr46uN+t34/hpRboEWa1WBPcomSDs6+tDgUBgVgSFz+h5Wb4Uk7hKVxnr8wzrSGxeL5132/WWlfm3EFKEH4BCFShMBIVqUEiBQg2oYADqmcD3dOFcxYvL+/WNB02FEMv7vWyUn+dluF0lkC6BnYYDaXd3dwQUzYJghO+ugyb3dyQzp8G6wYDj3tYmhd/vl/x3q89EJHUW6SxTDkDZhDHEFFA4xQSe41Bvy3MU9Iik5gFKYZy5+u31ufrVRKlto4Tv6UegEE1xmed5FAqFkCAIBDj+As/Z02WknUcxKSudOQaj52xaOv7dcjFf+gPOQ6EgCgaD/9ZmrUwd/TB+qa7pjjZ5xqRJLiuxcwMDAwyoUoG6MPxd75hRUaTdxp1pLeW5xo66U9rvMBGB910MPh/PZ0ChDBMygCTsNrG/v5+GBEoA4D3Q00t9E8WIdtv5KPe+rNz2mrwUyJPxva9oQfhAcki+IFBAOPdgVyJEkupM2kz3CV3WnAXYlMkuDwE8eQW/zVPjqTXxzh36bcRRdAm9ZcvRp6FfRkwYh3diCibCLpcUFxHCBmsOIbuPUtWPV6SmuQoMW1y7DYVP1hkWkvk7vkvSx4+gbu4dGbE/Me26p4iJq8vWbnKXJWc0nFyW+E+jgL/YgOW2IjODFT7bk6NvPLzBxt61Gj4OuVRjYMAP8TuYwylBgVIcG6PwDm3iV5XiOE45PDxMDQ4O0l6vV4oJ8dgkQcuRwRExovqYLdXTelNT6RMV9srrsXiUrl6pXHy7tlbDA4G9oiIOhp+uqanR2O32OLg7uqqqapHD4cC507zLyk3E1epDcsXhojRVfELyAmO2KXIvQnIHYKspW52ekUFBiiQhIWHBeJUMjU9D2BQrmDJ5sVWrVtw4Z9SZC/ekFuzfl+jS6mIfJOsNB8xmnaWkZO3R0lI5+ePq6nANKEY/AZI2ePK4kYneAAAAAElFTkSuQmCC'); background-size: cover; display: block;"></span>

<img class="gatsby-resp-image-image" alt="Disrupting Commercial Real Estate" title="Disrupting Commercial Real Estate" src="/static/a9e8d0e4bdcf5aee4aa81d24b0312efc/16bf3/commercial-real-estate.png" srcset="/static/a9e8d0e4bdcf5aee4aa81d24b0312efc/064a4/commercial-real-estate.png 225w,

/static/a9e8d0e4bdcf5aee4aa81d24b0312efc/44727/commercial-real-estate.png 450w,

/static/a9e8d0e4bdcf5aee4aa81d24b0312efc/16bf3/commercial-real-estate.png 598w" sizes="(max-width: 598px) 100vw, 598px" loading="lazy">

</a>

</span>

</div>

<p>Imagine if building owners were perfectly incentivized to upgrade their buildings and energy efficiency technology adoption rates jumped from 10% to 90%. In addition to turning on one of the most prolific methods for reducing greenhouse gas emissions, PACE could unleash over $1 trillion dollars of investment that owners would direct towards important environmental upgrades. All the low-hanging fruit of energy and water efficiency optimization would immediately be picked; all deferred maintenance would be completed; and underutilized space, such as rooftops, would become lucrative opportunities for building owners to generate power or improve the tenant experience with green space. Such a future is not far off. Currently, the fastest growing source of financing in the U.S., PACE is following the same growth trajectory as CMBS, the largest source of financing in the U.S. for building projects.</p>

<p>As markets learn to use PACE at a meaningful scale, its impact will be felt across industries. Already, the earliest signs of disruption can be seen. Legacy interests in the banking community who view PACE as competition to their less eloquent loan products are beginning to offer PACE products. Contractors who quickly learned the basics of PACE are starting to grab market share from their less responsive and often much larger competitors, presenting themselves as PACE experts and offering a solution that sets them far apart.</p>

<p>Could PACE be the special ingredient that makes green buildings commonplace? Such a market shift is not without precedent. Before Power Purchase Agreements (PPAs) were introduced to the solar industry, rooftop solar was a luxury consumer product; however, the advent of the PPA made solar energy an economically attractive option for millions of building owners. Today, solar is the fastest growing new sources of power in the country and is positioned to become a material component of the overall power mix of the nation.</p>

<p>Having only developed the public sector infrastructure necessary to handle the cash streams over the last 3 to 5 years, PACE is still in its infancy; yet the depth of its potential is clear. Red and blues states across the country are passing legislation to enable it, making it the fastest growing financial tool in the U.S. As PACE goes mainstream, vendors who align with this disruptive tool will emerge as new industry leaders and products once thought to be luxuries will become the new standard.</p>

Read moreFuturistic Green Building Technologies You Won’t Believe

<p>Picture an office that cleans up after itself, improves indoor air quality with nanotech-formulated paint, and responds to sunlight by magically adjusting window tint, all while fighting climate change. Then imagine entering your workspace to find your desk light on and the temperature just as you like it. Though it may sound like a scene from a fictional sci-fi movie, these innovations are already at work in some modern buildings, in the form of a networked ecosystem of “intelligent” building equipment and devices.</p>

<p>Beyond the “Wow!” factor and the large-scale benefits to our planet, green and smart building technologies are changing the way we live and work, and creating business opportunities for technology innovators, commercial building owners and tenants. Buildings designed with sustainability-supporting materials, Big-Data-crunching automated systems, and onsite clean energy are expected to represented 55 percent of all U.S. commercial and institutional construction in 2015, according to McGraw-Hill Construction’s Dodge Construction Green Outlook. Recent research from groups like CO2 Scorecard, demonstrate that these kinds of advancements in how people consume energy have contributed twice as much to the recent drop in U.S. GHG emissions as the reduced use of coal in favor of natural gas.</p>

<p>It’s no coincidence: sustained public interest in sustainability has triggered a surge of green building innovation. Spiraling water concerns and energy costs have sparked resource-efficient building operations among commercial property owners and occupiers. New regulations in many U.S. states and municipalities provide further motivation in the form of energy disclosure ordinances or tax incentives for sustainable construction and building operations. Also important is the growing body of research showing that green buildings are good for employee health and well-being. Corporate tenants are willing to pay higher rents for the resulting workplace productivity gains, while employees and consumers alike prefer companies that are socially and environmentally responsible.</p>

<p>Here are a few of the building technologies that are changing the game of greening the planet –and transforming our culture in the process.</p>

<h2>Nanotech Wonders: Paint that invisibly cleans air and more</h2>

<div class="up-articles__content__image up-articles__content__image--left" style="width: 300px">

<span class="gatsby-resp-image-wrapper" style="position: relative; display: block; margin-left: auto; margin-right: auto; max-width: 318px;">

<a class="gatsby-resp-image-link" href="/static/4f83944c59dd1883e7d3b62ae7a7cf86/7b765/nanotech-wonders.jpg" style="display: block" target="_blank" rel="noopener">

<span class="gatsby-resp-image-background-image" style="padding-bottom: 50%; position: relative; bottom: 0; left: 0; background-image: url('data:image/jpeg;base64,/9j/2wBDABALDA4MChAODQ4SERATGCgaGBYWGDEjJR0oOjM9PDkzODdASFxOQERXRTc4UG1RV19iZ2hnPk1xeXBkeFxlZ2P/2wBDARESEhgVGC8aGi9jQjhCY2NjY2NjY2NjY2NjY2NjY2NjY2NjY2NjY2NjY2NjY2NjY2NjY2NjY2NjY2NjY2NjY2P/wgARCAAKABQDASIAAhEBAxEB/8QAGAAAAgMAAAAAAAAAAAAAAAAAAAMBAgX/xAAVAQEBAAAAAAAAAAAAAAAAAAABAP/aAAwDAQACEAMQAAAB1WRZFDSP/8QAGRAAAgMBAAAAAAAAAAAAAAAAACECETFB/9oACAEBAAEFArQyOdP/xAAUEQEAAAAAAAAAAAAAAAAAAAAQ/9oACAEDAQE/AT//xAAUEQEAAAAAAAAAAAAAAAAAAAAQ/9oACAECAQE/AT//xAAaEAACAgMAAAAAAAAAAAAAAAAAEBEhcYHR/9oACAEBAAY/ApvBB1aX/8QAHRABAAIBBQEAAAAAAAAAAAAAAQARIRAxQVFhkf/aAAgBAQABPyEQsjv4jaq+y6Gb9wYBqlzrxo//2gAMAwEAAgADAAAAEOP/AP/EABURAQEAAAAAAAAAAAAAAAAAAAEQ/9oACAEDAQE/ECf/xAAVEQEBAAAAAAAAAAAAAAAAAAABEP/aAAgBAgEBPxBn/8QAHRABAAICAgMAAAAAAAAAAAAAAQARITFBYVGR0f/aAAgBAQABPxCgCqsoba++4iBCsOqHrs3MMJBTkHykBCCNiXzEEMtJTh1NLP/Z'); background-size: cover; display: block;"></span>

<img class="gatsby-resp-image-image" alt="Nanotech Wonders: Paint that invisibly cleans air and more" title="Nanotech Wonders: Paint that invisibly cleans air and more" src="/static/4f83944c59dd1883e7d3b62ae7a7cf86/7b765/nanotech-wonders.jpg" srcset="/static/4f83944c59dd1883e7d3b62ae7a7cf86/40f63/nanotech-wonders.jpg 225w,

/static/4f83944c59dd1883e7d3b62ae7a7cf86/7b765/nanotech-wonders.jpg 318w" sizes="(max-width: 318px) 100vw, 318px" loading="lazy">

</a>

</span>

</div>

<p>Does the paint in your office clear the air? Now it can. A Philippines-based company, Pacific Paint (Boysen®) Philippines Inc. created the world’s first air-cleaning paint. It’s based on nanoscale titanium dioxide, used to reduce harmful emissions in power plants and motor vehicles. It interacts with light to break down nitrous oxide and volatile organic compounds (VOCs) into harmless substances.</p>

<p>Nanotechnology is also behind smart electrochromic glass windows that can respond to environmental conditions. These windows can be integrated with building automation systems and programmed, along with other building equipment, to utilize natural sunshine and heat to offset the need for artificial lighting and artificial heating from HVAC.</p>

<p>Nanotechnology can even improve hygiene: Adding silver nanoparticles to paint can add lasting antimicrobial properties, an infection-prevention technique borrowed from the medical world. The biocidal effect of the released silver ions prevents the growth of mold, algae and bacteria.</p>

<p>Innovation in materials science and production technologies has made green building materials a thriving industry sector, with the global market projected to reach $529 billion by 2020, according to research firm Global Industry Analysts. For example, one category of new creative sustainably produced products is fire-retardant insulation produced from would-be waste materials such as shredded denim, plastic milk bottles, newspapers, agricultural straw, hemp and flax.</p>

<h2>HAL 9000? More like the coolest treehouse ever</h2>

<div class="up-articles__content__image up-articles__content__image--left" style="width: 370px">

<span class="gatsby-resp-image-wrapper" style="position: relative; display: block; margin-left: auto; margin-right: auto; max-width: 610px;">

<a class="gatsby-resp-image-link" href="/static/ff1c4a2e8b986925b534066f6f3c2573/4b0de/hal-9000.jpg" style="display: block" target="_blank" rel="noopener">

<span class="gatsby-resp-image-background-image" style="padding-bottom: 59.83606557377049%; position: relative; bottom: 0; left: 0; background-image: url('data:image/jpeg;base64,/9j/2wBDABALDA4MChAODQ4SERATGCgaGBYWGDEjJR0oOjM9PDkzODdASFxOQERXRTc4UG1RV19iZ2hnPk1xeXBkeFxlZ2P/2wBDARESEhgVGC8aGi9jQjhCY2NjY2NjY2NjY2NjY2NjY2NjY2NjY2NjY2NjY2NjY2NjY2NjY2NjY2NjY2NjY2NjY2P/wgARCAAMABQDASIAAhEBAxEB/8QAGAAAAwEBAAAAAAAAAAAAAAAAAAMFAQT/xAAWAQEBAQAAAAAAAAAAAAAAAAAEAgP/2gAMAwEAAhADEAAAAY7t7lHiDidP/8QAGxAAAgIDAQAAAAAAAAAAAAAAAQIAAxAREiH/2gAIAQEAAQUCROjZSVwnk2WQz//EABgRAAIDAAAAAAAAAAAAAAAAAAABAhES/9oACAEDAQE/AXJ2aP/EABURAQEAAAAAAAAAAAAAAAAAAAAS/9oACAECAQE/AZS//8QAGBAAAwEBAAAAAAAAAAAAAAAAARARAEH/2gAIAQEABj8CmrhPF//EABoQAAMBAAMAAAAAAAAAAAAAAAABESExQVH/2gAIAQEAAT8hiUkVIaS6hB3peG5mjyP/2gAMAwEAAgADAAAAEMff/8QAFhEBAQEAAAAAAAAAAAAAAAAAAAER/9oACAEDAQE/EItIf//EABYRAQEBAAAAAAAAAAAAAAAAAAEAEf/aAAgBAgEBPxDGBN//xAAbEAEBAQEAAwEAAAAAAAAAAAABEQAhQVGBkf/aAAgBAQABPxBrgfeiU1UqWz5zLGTKKdrxhuhnr39+YF83/9k='); background-size: cover; display: block;"></span>

<img class="gatsby-resp-image-image" alt="HAL 9000? More like the coolest treehouse ever" title="HAL 9000? More like the coolest treehouse ever" src="/static/ff1c4a2e8b986925b534066f6f3c2573/4b0de/hal-9000.jpg" srcset="/static/ff1c4a2e8b986925b534066f6f3c2573/40f63/hal-9000.jpg 225w,

/static/ff1c4a2e8b986925b534066f6f3c2573/df2c7/hal-9000.jpg 450w,

/static/ff1c4a2e8b986925b534066f6f3c2573/4b0de/hal-9000.jpg 610w" sizes="(max-width: 610px) 100vw, 610px" loading="lazy">

</a>

</span>

</div>

<p>You arrive at your office building. The elevator is waiting for you as soon as you enter the lobby. It takes you straight to your floor without you pressing a button. You find your workspace ready for you, with lighting and temperature as you prefer, and your computer turned on for use. All this triggered when you parked your electric car in a wireless charging spot in the parking garage. Intelligent building automation systems are bringing this scenario to life today.</p>

<p>While it’s common to describe smart buildings as being driven by a brain, the future doesn’t really resemble HAL 9000—the sentient computer of Arthur C. Clarke’s 2001: A Space Odyssey. Instead, the intelligence is becoming increasingly distributed in an ecosystem of connected devices and equipment engaged in machine-to-machine (M2M) communications. Like natural habitats such as trees or coral reefs, the parts of the ecosystem of a building are specialized to serve distinct functions with minimal intervention from the users.</p>

<p>Today’s smart buildings house networks of interactive, programmable devices and equipment providing heating, cooling, elevators, lighting, security and more.</p>

<p>Smart lighting, in particular, has become has become a fast-growing Internet of Things category according to global technology research firm ON World. The firm predicts that, by 2020, 100 million Internet-connected wireless light bulbs and lamps will be installed. As one of best sources from which to save energy and improve workplace functionality, whole lighting systems can respond to the availability of natural light or presence of occupants spread across a building and automatically adjust in real-time down to the level of a single bulb.</p>

<p>While traditional building equipment in older buildings still lacks embedded intelligence, companies like Enlighted can leverage existing building management systems to introduce operation optimization algorithms to otherwise dumb equipment. The Silicon Valley-based global provider of end-to-end managed application services also uses cloud technology to connect the disparate building systems within a single building or across whole global portfolios. Combined with skilled facilities management staff, this level of integration opens new frontiers in how humans, machines and buildings can interact.</p>

<h2>Energy sourcing: onsite energy technology goes net zero</h2>

<p>First the bad news: The United States generates more CO2 emissions than any country in the world except China; and commercial and residential properties generate approximately 40 percent of these emissions in the United States, according to the U.S. Green Building Council. Energy consumption is the driver of all this. With nearly 30 percent of the $202 billion spent annually on U.S. commercial and industrial energy wasted, it’s not surprising that energy efficiency is a priority for commercial property owners. In fact, investing $279 billion in U.S. building efficiency could save more than $1 trillion in energy costs over 10 years, with every dollar invested producing three dollars of operational savings, according to report from The Rockefeller Foundation and Deutsche Bank Group.</p>

<div class="up-articles__content__image up-articles__content__image--right" style="width: 370px">

<span class="gatsby-resp-image-wrapper" style="position: relative; display: block; margin-left: auto; margin-right: auto; max-width: 768px;">

<a class="gatsby-resp-image-link" href="/static/d48618dd275bb80945d5bd0aab1d2a54/7fd22/energy-sourcing.jpg" style="display: block" target="_blank" rel="noopener">

<span class="gatsby-resp-image-background-image" style="padding-bottom: 56.25%; position: relative; bottom: 0; left: 0; background-image: url('data:image/jpeg;base64,/9j/2wBDABALDA4MChAODQ4SERATGCgaGBYWGDEjJR0oOjM9PDkzODdASFxOQERXRTc4UG1RV19iZ2hnPk1xeXBkeFxlZ2P/2wBDARESEhgVGC8aGi9jQjhCY2NjY2NjY2NjY2NjY2NjY2NjY2NjY2NjY2NjY2NjY2NjY2NjY2NjY2NjY2NjY2NjY2P/wgARCAALABQDASIAAhEBAxEB/8QAGAAAAwEBAAAAAAAAAAAAAAAAAAIEAwX/xAAVAQEBAAAAAAAAAAAAAAAAAAABAP/aAAwDAQACEAMQAAABamXMGOkN/8QAHBAAAgICAwAAAAAAAAAAAAAAAQIAAwQSEyEx/9oACAEBAAEFAltAGNYY++2Mi8adRvf/xAAVEQEBAAAAAAAAAAAAAAAAAAAAEf/aAAgBAwEBPwGI/8QAFREBAQAAAAAAAAAAAAAAAAAAABH/2gAIAQIBAT8BV//EABwQAAICAgMAAAAAAAAAAAAAAAExAAIQEhEhIv/aAAgBAQAGPwI1B9cTU9xRNywC3x//xAAcEAEAAgEFAAAAAAAAAAAAAAABACERMUFhcbH/2gAIAQEAAT8hKnadSwoDeEWfEJoe0WdYYwjaf//aAAwDAQACAAMAAAAQSB//xAAWEQEBAQAAAAAAAAAAAAAAAAABABH/2gAIAQMBAT8QdOzf/8QAFhEAAwAAAAAAAAAAAAAAAAAAARAR/9oACAECAQE/EKV//8QAHBABAAIDAQEBAAAAAAAAAAAAAREhADFBcVGh/9oACAEBAAE/EAltg0vdLzFrpb0hFe3X3FpEDjmAGaG1/rEvIAjgUYbRLGf/2Q=='); background-size: cover; display: block;"></span>

<img class="gatsby-resp-image-image" alt="Energy sourcing" title="Energy sourcing" src="/static/d48618dd275bb80945d5bd0aab1d2a54/7fd22/energy-sourcing.jpg" srcset="/static/d48618dd275bb80945d5bd0aab1d2a54/40f63/energy-sourcing.jpg 225w,

/static/d48618dd275bb80945d5bd0aab1d2a54/df2c7/energy-sourcing.jpg 450w,

/static/d48618dd275bb80945d5bd0aab1d2a54/7fd22/energy-sourcing.jpg 768w" sizes="(max-width: 768px) 100vw, 768px" loading="lazy">

</a>

</span>

</div>

<p>Now the good news: An energy efficiency call to action is being heeded. U.S. GhG emissions have declined by 10 percent since 2005 primarily thanks to energy efficiency. To further accelerate these reductions, we can compound the efficiency gains on the demand side with improvements on the supply side.</p>

<p>The transformation of energy markets from coal to natural gas – enabled in part by fracking – is already showing how quickly a low carbon energy supply impacts national greenhouse gas emissions. Building-integrated energy generation has the potential to be even more disruptive.</p>

<p>Adoption of onsite renewable energy technologies is rapidly increasing. Tax incentives and technological advances have made wind, geothermal and solar power installation, smaller, more powerful and more affordable today than in the past. They can even be incorporated into traditional building materials, substantially reducing installation and material costs. Solar power generating paint, windows, and road-surfacing materials are just a few of the applications for building component materials happening today.</p>

<p>Waste conversion technologies are also on the rise. New alternative options include biogas digesters that can turn methane from food waste into electricity. On a smaller scale, it is becoming common place for a building can to use refrigerator exhaust to heat water, heat exchangers to heat the building with the heat generated by office machines and computers, or drivers to convert the motion of vertical transportation systems into electricity. For existing buildings which are expensive to retrofit with these new advanced technologies, building owners can partner with renewable energy companies that will install and maintain energy equipment at no cost, in exchange for an energy-purchase agreement and the right to sell excess energy to the municipal grid. In fact, commercial property owners can use an energy matchmaking service that recommends the most cost-effective options, also at no cost to the property owner—a timely service, given the growing universe of highly technical solutions.</p>

<p>New renewable energy technologies, and falling prices for older technologies, have led to the emergence of “net-zero” and “Living Building” standards for environmentally friendly buildings. While exact definitions vary, the concept is that the total energy a building consumes annually is equal to or less than the amount of energy it creates. Most zero-energy buildings tap the public electrical grids for energy storage and backup power, but some are entirely independent. All rely on some form of renewable energy, combined with energy-efficient building design, systems and operation.</p>

<p>For all the advancements in building-integrated renewable energies, you might be wondering you haven’t heard of it having a bigger impact already. The truth is that the building-integrated energy generation sector hasn’t had its “fracking moment,” but that may be just around the corner. The biggest barrier to more wide-spread adoption is efficient energy storage, and solutions are coming. Startups are emerging around the world with innovative products. Even automakers like BMW are getting involved. Solving this issue will do as much for building-integrated and distributed energy as the development of Nikola Tesla’s AC current generators did for centralized district power nearly a century ago.</p>

<h2>The incredible shrinking power grid</h2>

<div class="up-articles__content__image up-articles__content__image--left" style="width: 370px">

<span class="gatsby-resp-image-wrapper" style="position: relative; display: block; margin-left: auto; margin-right: auto; max-width: 610px;">

<a class="gatsby-resp-image-link" href="/static/554a91e64332e819ba68d316d39dcc9f/4b0de/power-grid.jpg" style="display: block" target="_blank" rel="noopener">

<span class="gatsby-resp-image-background-image" style="padding-bottom: 58.19672131147541%; position: relative; bottom: 0; left: 0; background-image: url('data:image/jpeg;base64,/9j/2wBDABALDA4MChAODQ4SERATGCgaGBYWGDEjJR0oOjM9PDkzODdASFxOQERXRTc4UG1RV19iZ2hnPk1xeXBkeFxlZ2P/2wBDARESEhgVGC8aGi9jQjhCY2NjY2NjY2NjY2NjY2NjY2NjY2NjY2NjY2NjY2NjY2NjY2NjY2NjY2NjY2NjY2NjY2P/wgARCAAMABQDASIAAhEBAxEB/8QAGAAAAwEBAAAAAAAAAAAAAAAAAAQFAgP/xAAVAQEBAAAAAAAAAAAAAAAAAAACA//aAAwDAQACEAMQAAABorTXaw2dhn//xAAZEAACAwEAAAAAAAAAAAAAAAABEgACAxH/2gAIAQEAAQUCUKc4kprdaaHhM//EABcRAQADAAAAAAAAAAAAAAAAAAASEyH/2gAIAQMBAT8Bhqp//8QAFxEAAwEAAAAAAAAAAAAAAAAAAAERE//aAAgBAgEBPwGs0Z//xAAZEAADAAMAAAAAAAAAAAAAAAAAECEREjH/2gAIAQEABj8ChxY2hav/xAAaEAEBAAIDAAAAAAAAAAAAAAABABFxITFB/9oACAEBAAE/IdSzZ9WsQFRI47S56L//2gAMAwEAAgADAAAAEHwP/8QAFxEAAwEAAAAAAAAAAAAAAAAAAAERIf/aAAgBAwEBPxBpBD2n/8QAFhEBAQEAAAAAAAAAAAAAAAAAAQAR/9oACAECAQE/EAhsr//EABwQAAIBBQEAAAAAAAAAAAAAAAERACExQWFxUf/aAAgBAQABPxAHdCRgjNZkOFwFuUUKHsHkgWA7GevG1qc03P/Z'); background-size: cover; display: block;"></span>

<img class="gatsby-resp-image-image" alt="Power Grid" title="Power Grid" src="/static/554a91e64332e819ba68d316d39dcc9f/4b0de/power-grid.jpg" srcset="/static/554a91e64332e819ba68d316d39dcc9f/40f63/power-grid.jpg 225w,

/static/554a91e64332e819ba68d316d39dcc9f/df2c7/power-grid.jpg 450w,

/static/554a91e64332e819ba68d316d39dcc9f/4b0de/power-grid.jpg 610w" sizes="(max-width: 610px) 100vw, 610px" loading="lazy">

</a>

</span>

</div>

<p>Combined, the use of smart building technologies and renewable energy is displacing the traditional centralized power model with the technology-driven distributed energy concept. Today, a group of connected buildings can become its own energy self-sufficient microgrid, exchanging power among its members from diverse power sources. With the emergence of interactive smart grids in some communities, a smart building can even sell excess energy to the utility company.</p>

<p>The United States may even see the kind of market disruption that Germany is already experiencing, where renewable energy powers half of the country’s electricity-generating capacity, and the system of centralized power generation is up-ended, in favor of locally generated power.</p>

<p>These innovations in futuristic building technologies represent only the tip of the iceberg when it comes to greening the built environment. As demand for sustainably created and operated buildings continues to grow, we expect more exciting developments will move from the lab into actual practice.</p>

Read more