Making clean energy

profitable for you

Our StoryWhere we came from

When I originally founded Unety, I made it our mission to level the playing field of an otherwise biased system that favored big corporations with special access to financial tools that uniquely made green building projects accretive.

I was raised in a small community, solely made up of mom-and-pop businesses, whose owners largely tried to live their values while eking out a living. Limited local opportunities led me to leave my hometown, and my journey shaped Unety's mission. I moved to New York City, and for 10 years my career focused on greening over 10 million square feet of commercial properties around the world. In that time, I witnessed a paradigm take shape: sustainability resources increasingly flowed to large players, while small businesses, like the ones in my hometown, were left stranded.

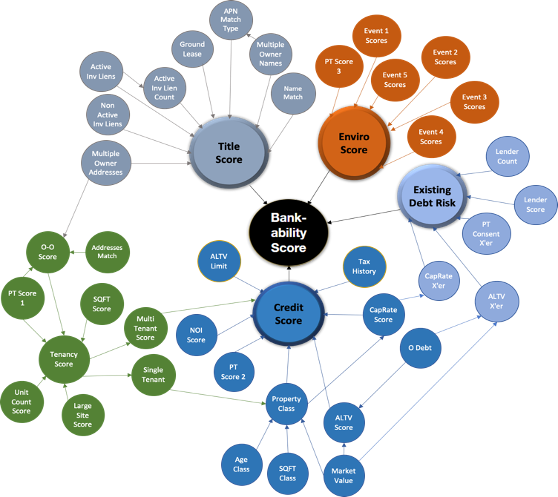

The first Eco-Bankability score

- Built on a robust proprietary data engine driven by a complex library of algorithms that assess the risk of a sustainability project.

- Manually calibrated against hundreds of publicly-rated property financings.

- Tested by heads of underwriting for leading lenders.

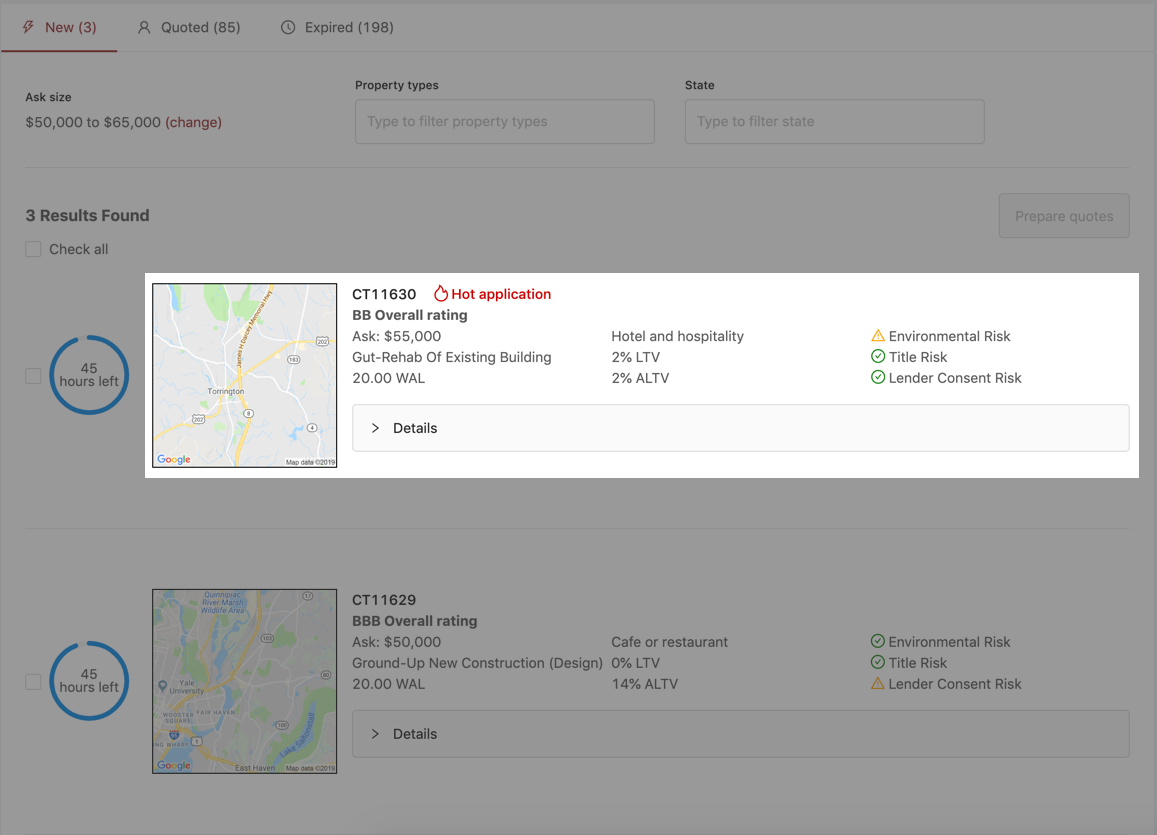

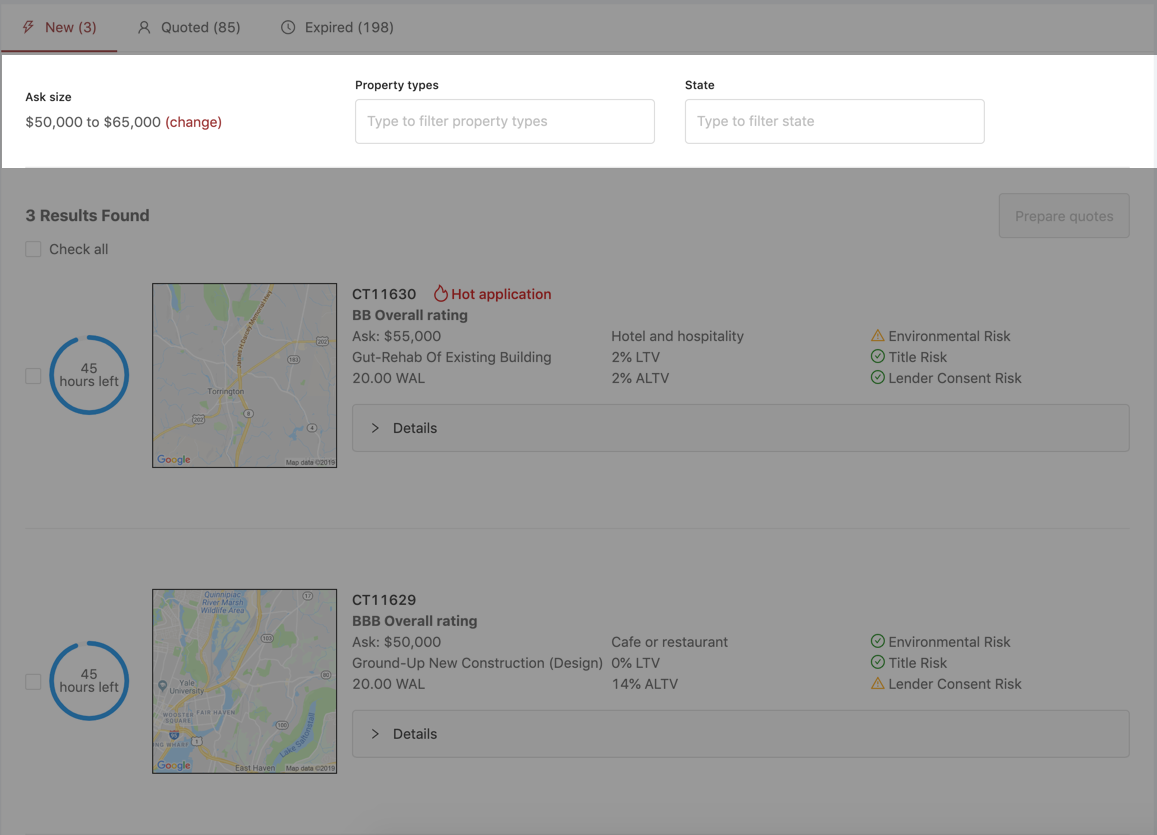

Tools forSustainable Financiers

Tools forSustainable Financiers

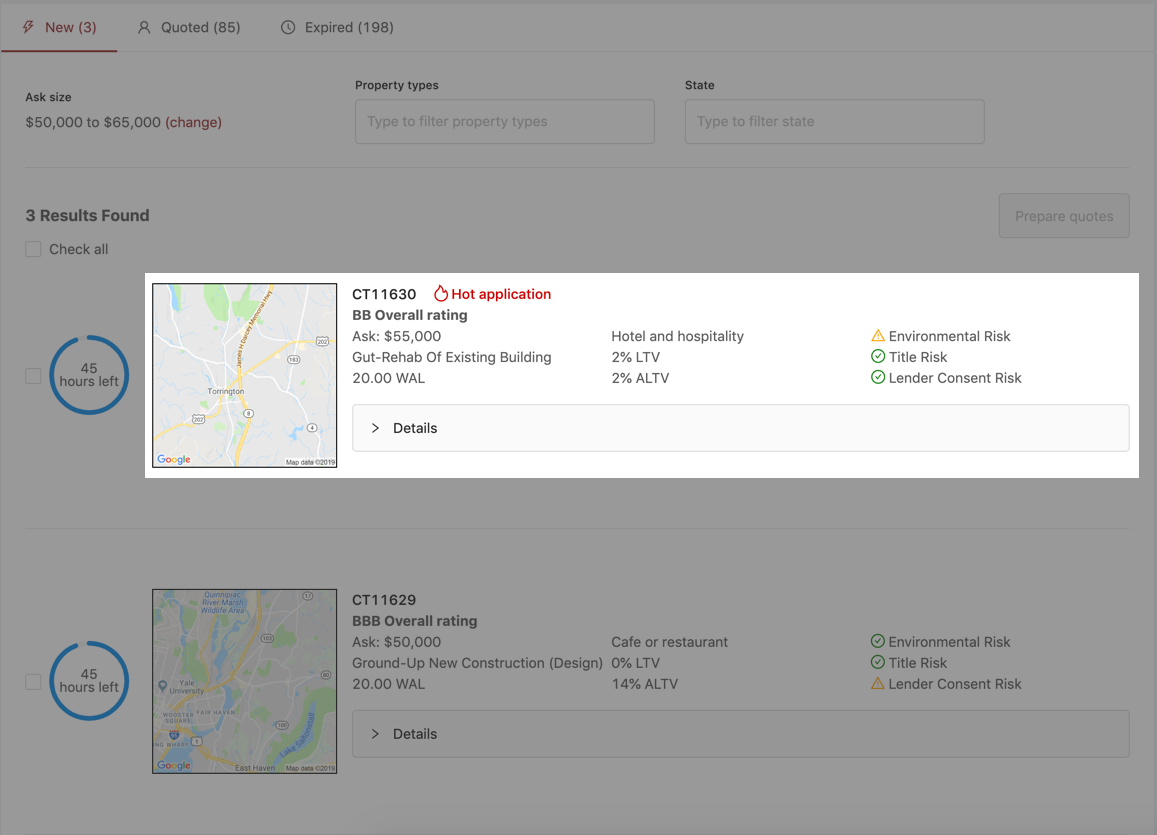

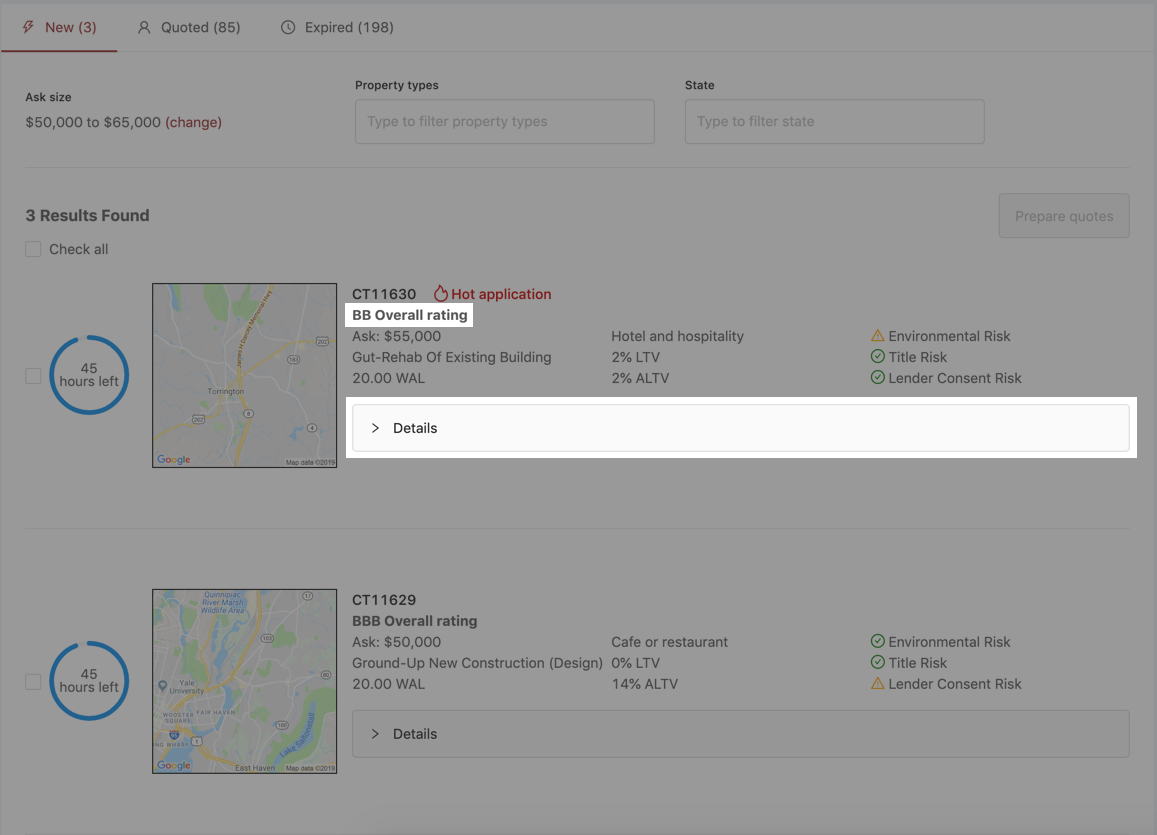

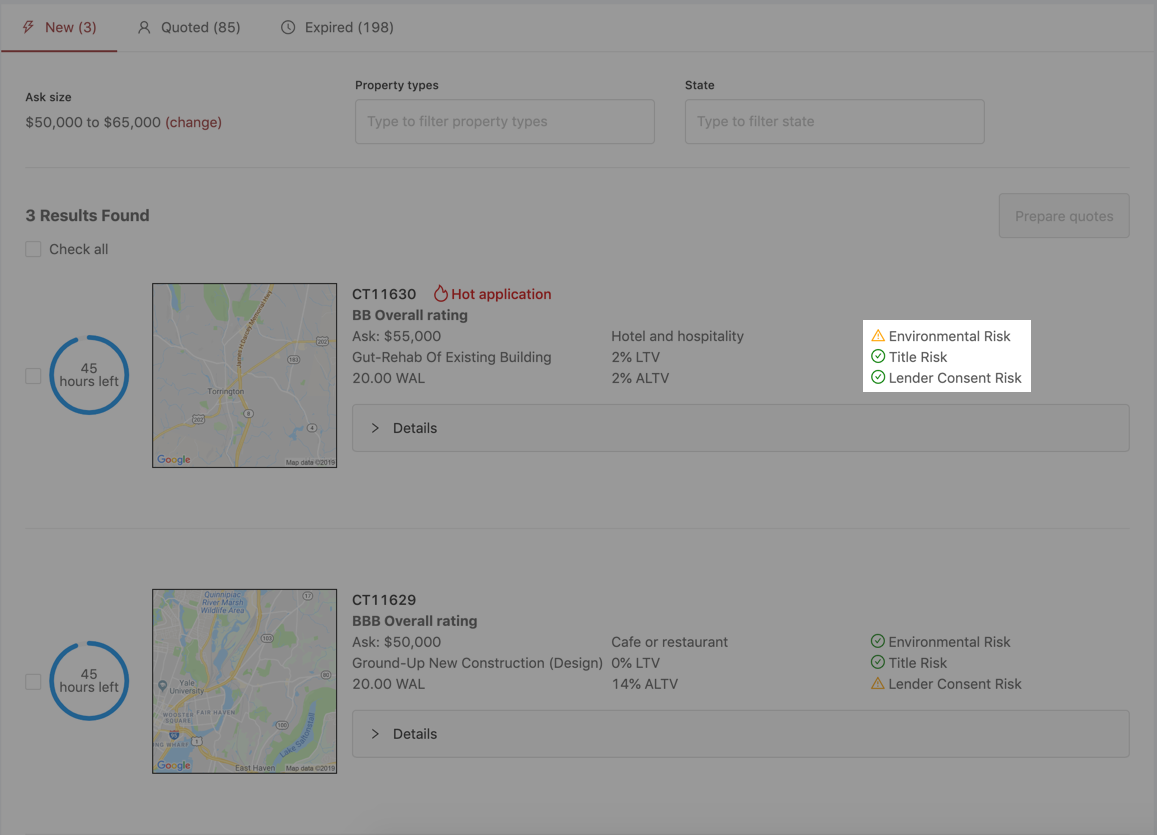

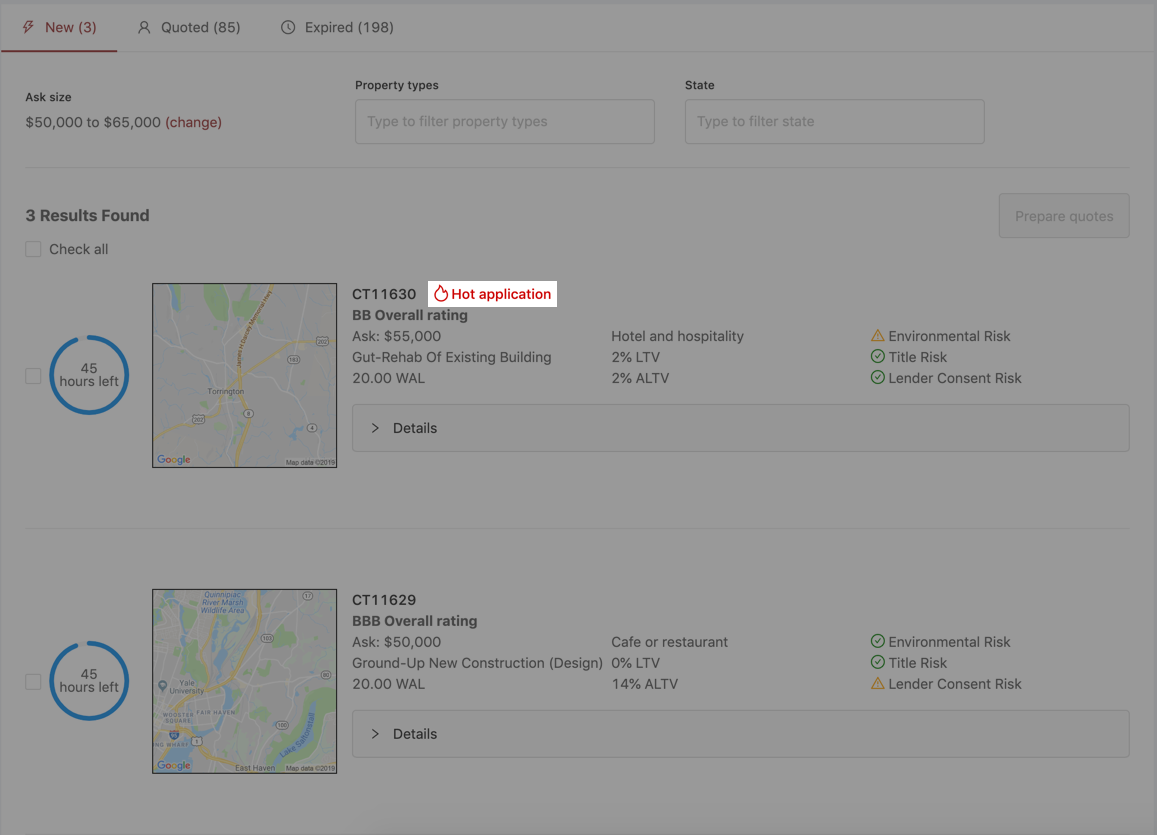

Easily make snap decisions with a clean view of all the most relevant qualifying conditions for each application.

Shadow credit ratings approximate rating agency scores; driven by our propritary scoring engine that processes hundreds of raw data points per property.

Customize acceptable risk thresholds for these key conditions whenever you want by adjusting your preference settings.

Identify which applications are most serious about quickly closing with you.

Browse through hundreds of applications from across the country in seconds and filter according to your priorities.

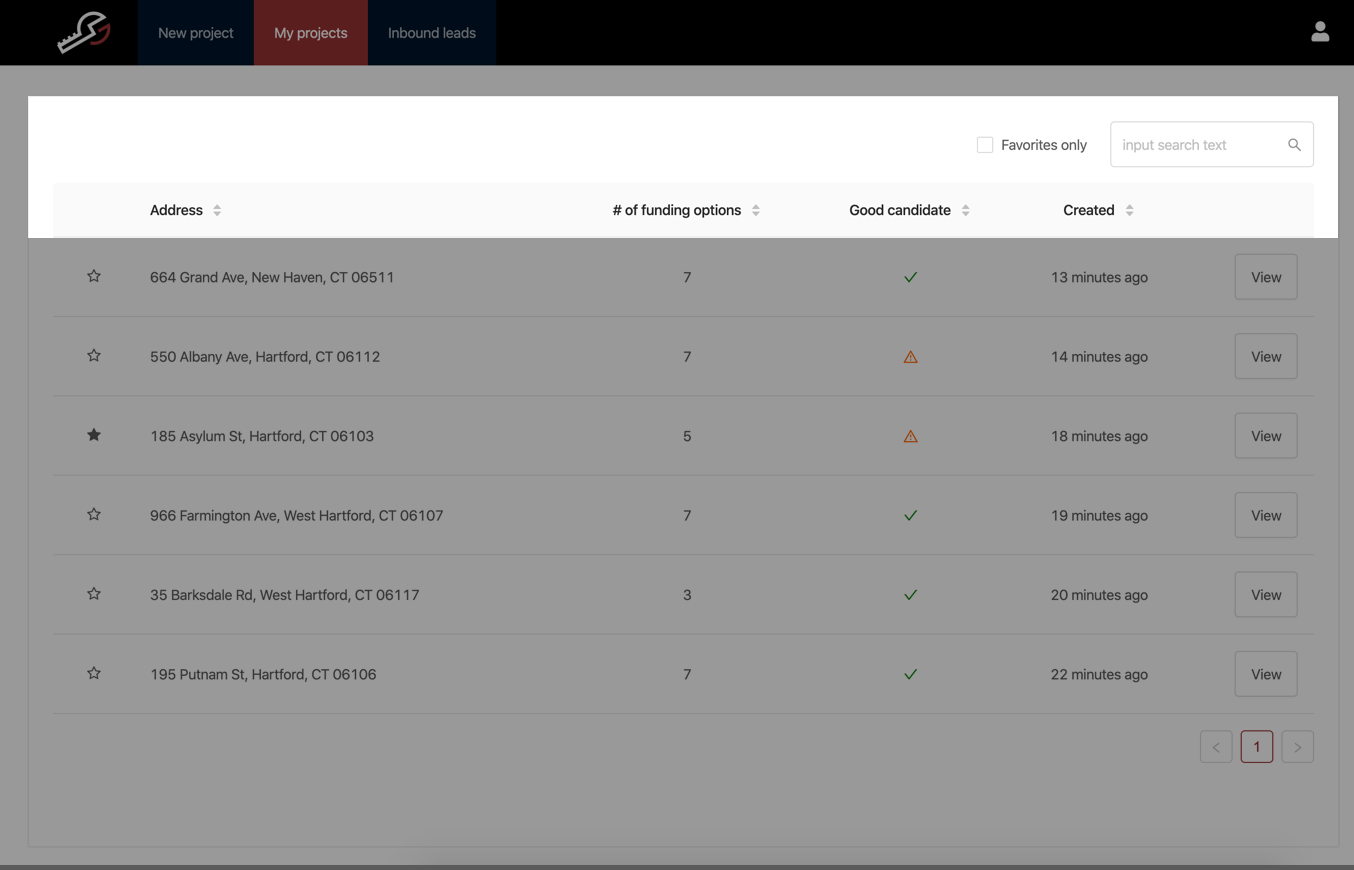

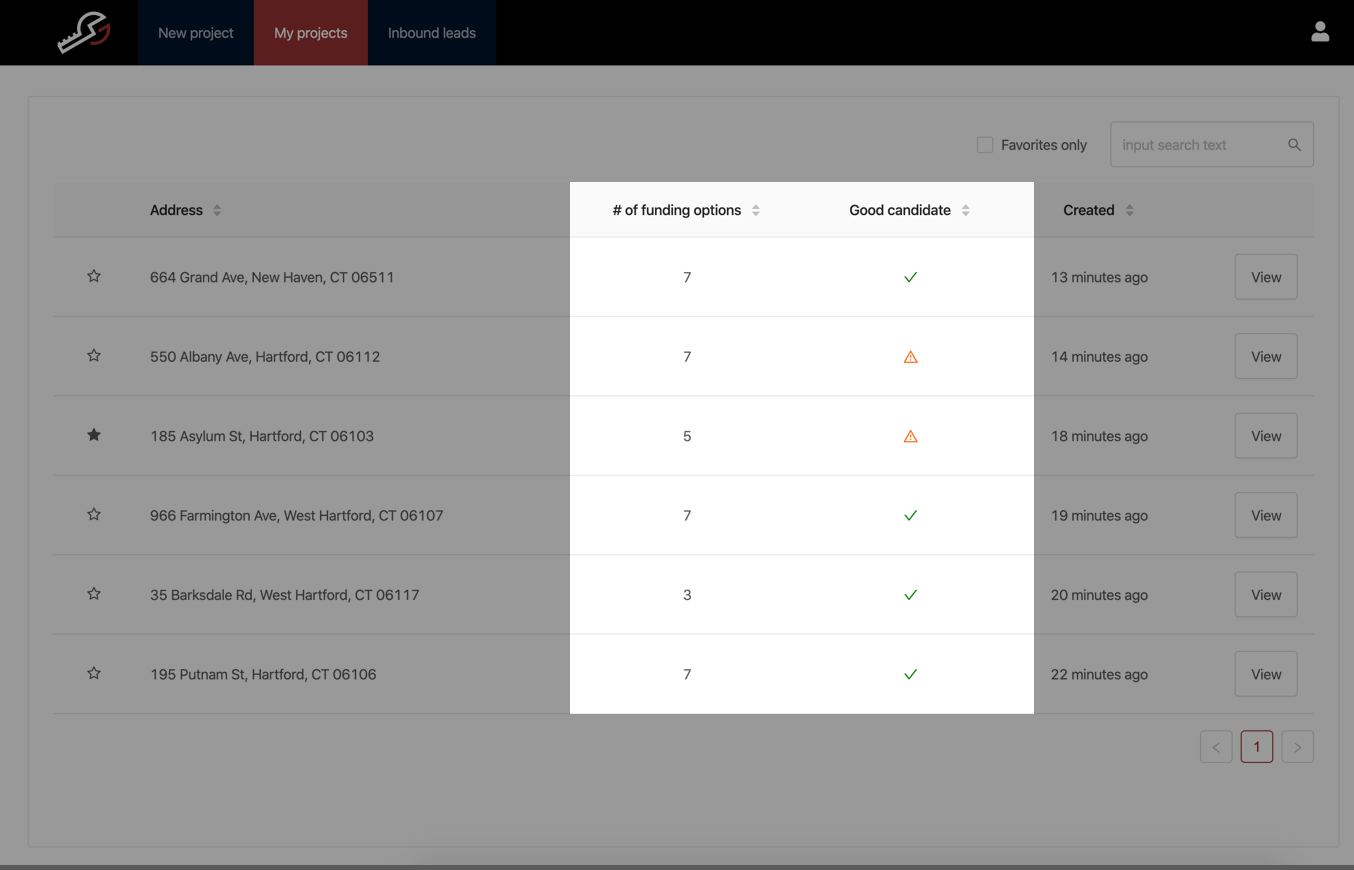

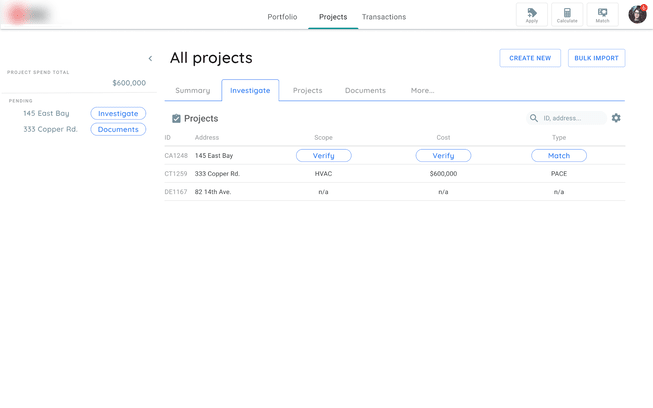

Tools for ESG ProfessionalsManage projects

Tools for ESG ProfessionalsManage projects

Manage, sort, and filter all of your projects in one place. Whether its a project you added yesterday or last year you can find it here

Identify the best financing for your projects and whether they are a good candidate for that financing.

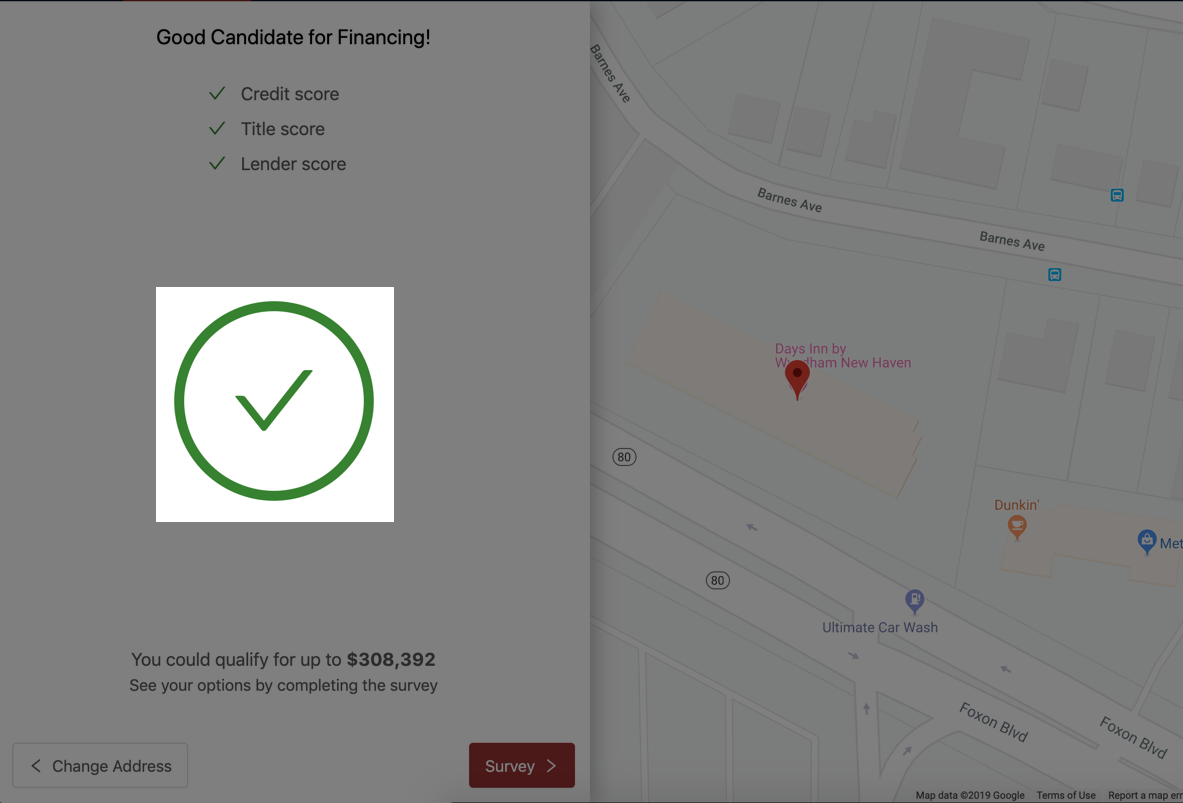

Tools for ESG ProfessionalsProject screening

Tools for ESG ProfessionalsProject screening

Prequalify a property in seconds. Just enter a property address and immediately discover if it meets the minimum program requirements for financing.

Explanations tailored to each property appear with the Validation results. If preapproved, few details are needed. If not preapproved, extra details are provided.

Over 90% of the commercial properties across the U.S. can be scored by simpling entering the address.

Tools for ESG ProfessionalsFunding options

Tools for ESG ProfessionalsFunding options

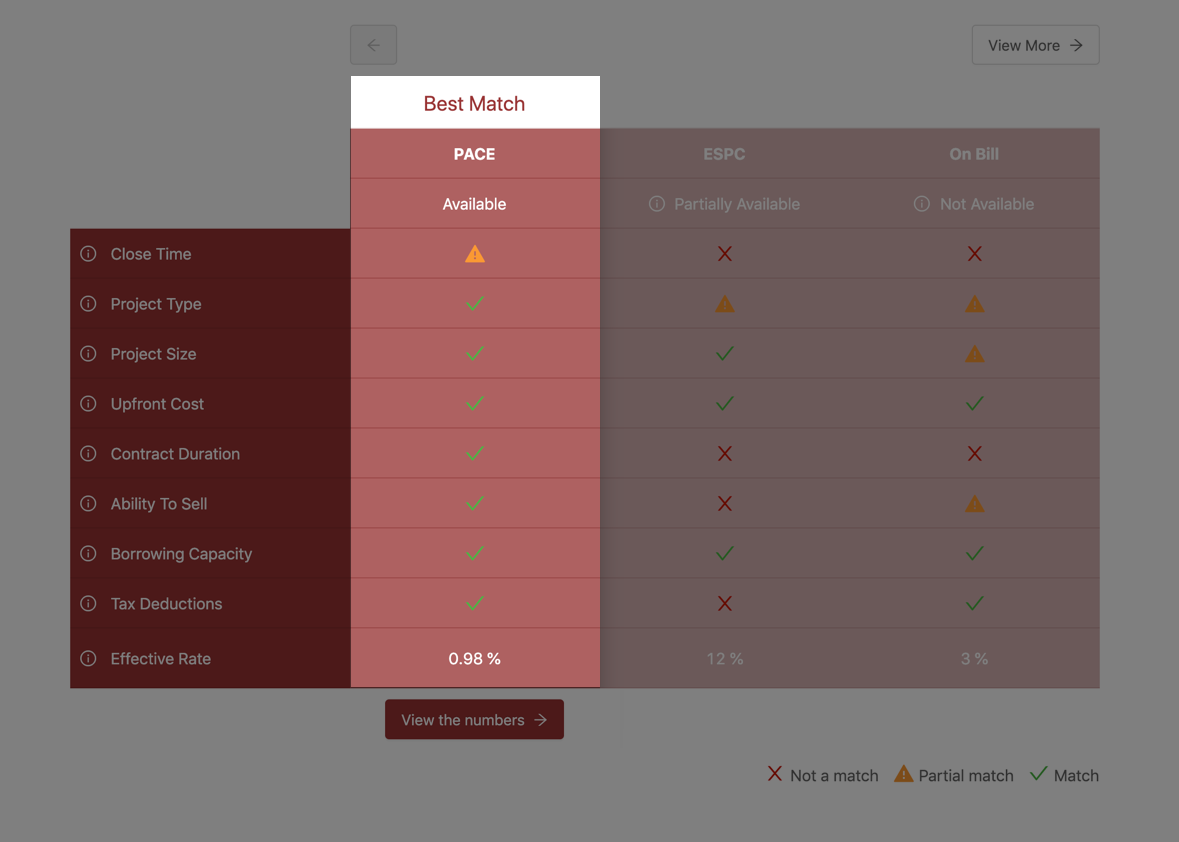

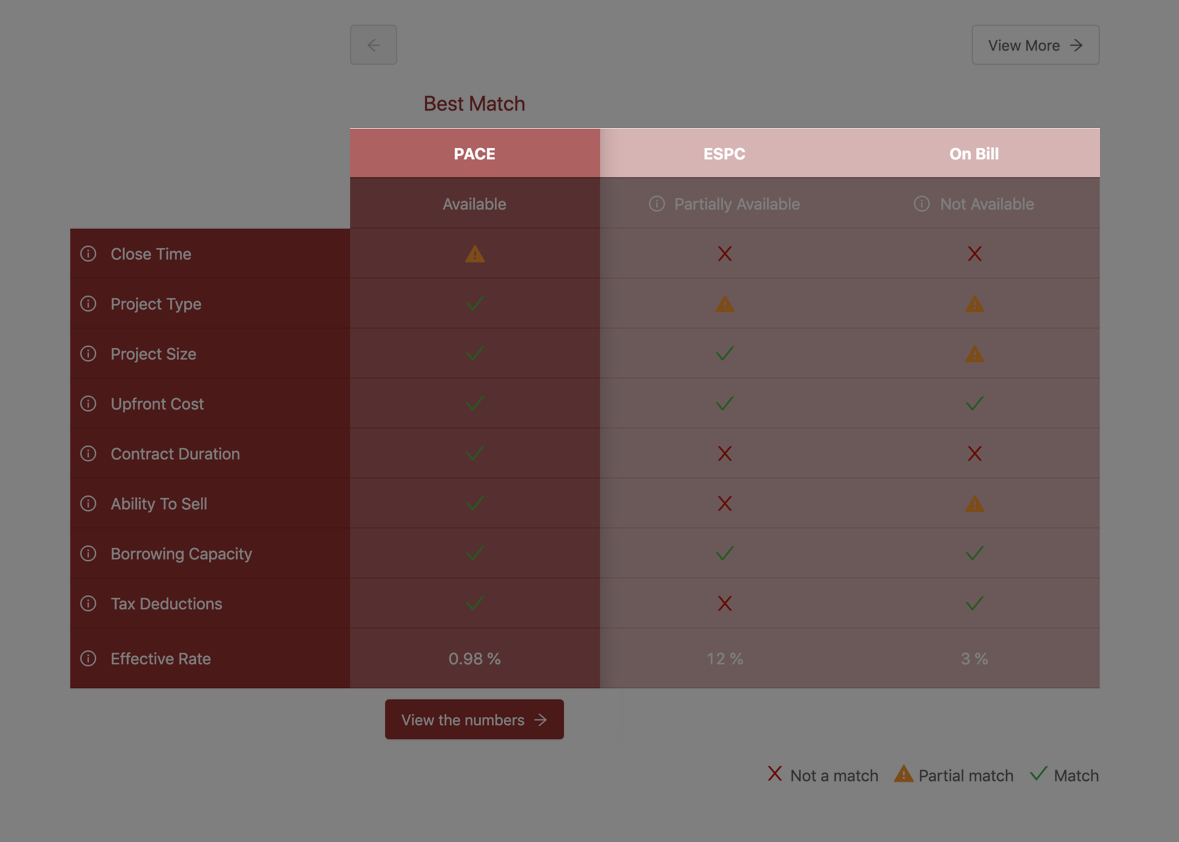

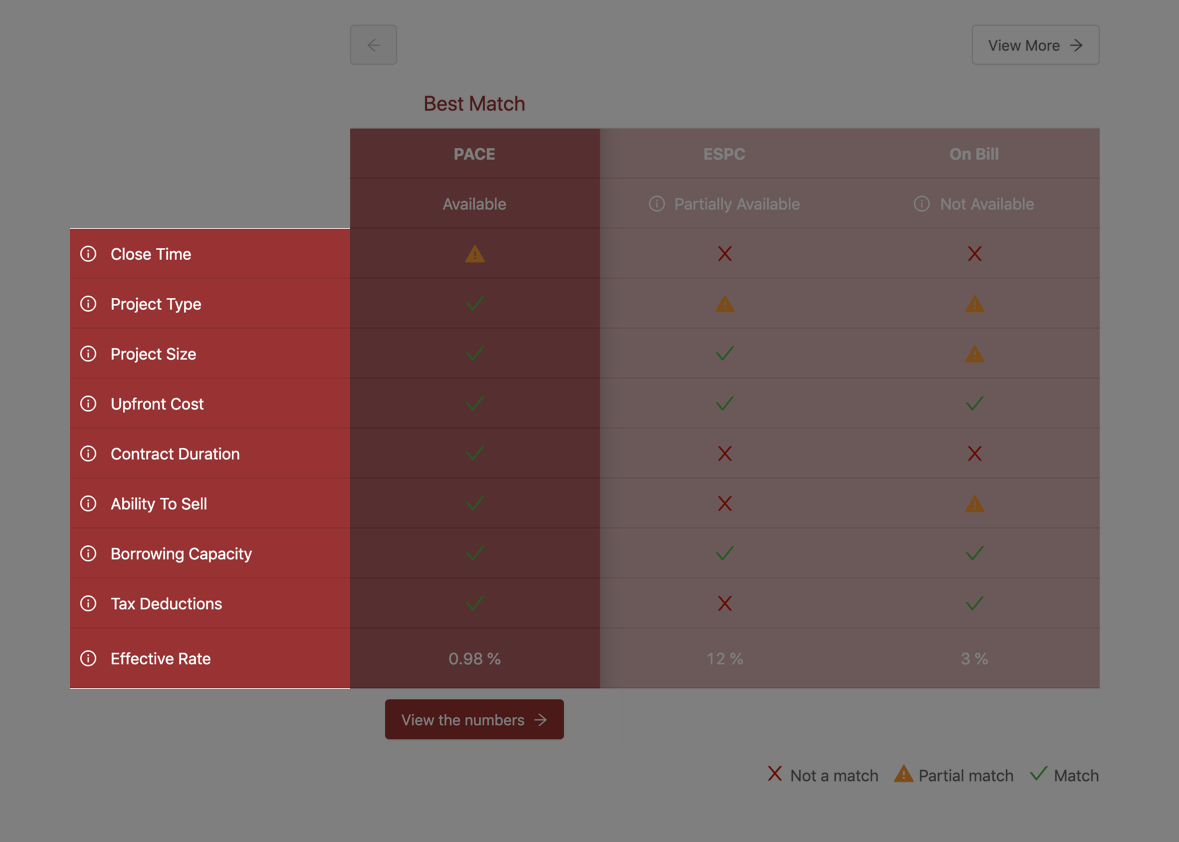

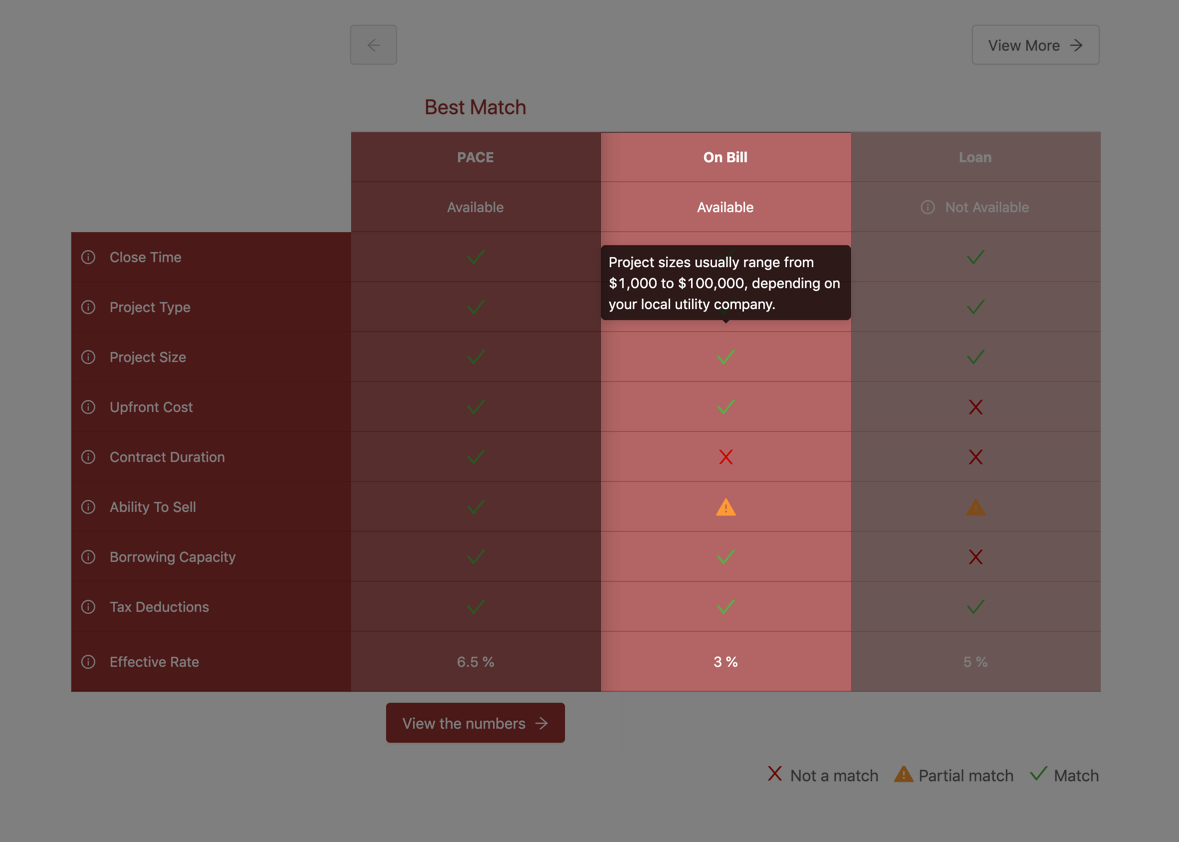

See which option is the best match for your property based on your unique needs. Every project is unique, and so are the results for your best match.

Get access to many of the special types of financing that large corporations have long benefited from. Our platform makes them directly available to you.

Customize your criteria according to your own unique needs. This ensures your get matched with a type of financing that is the best fit for you.

Explore the results in detail. Each result and criteria comes with a explanation that is unique to you.

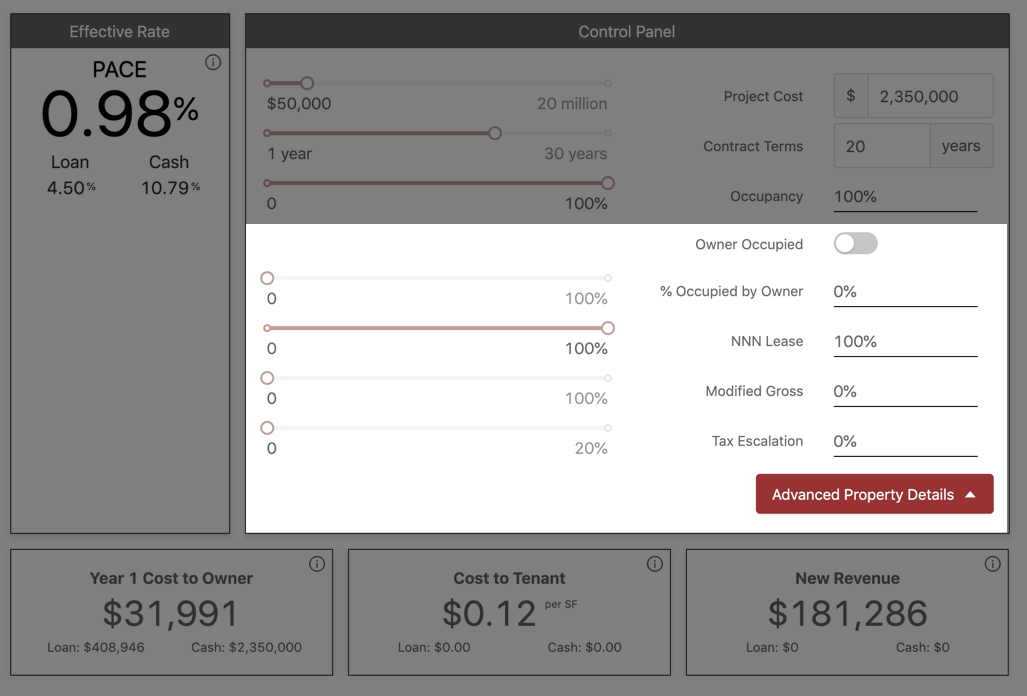

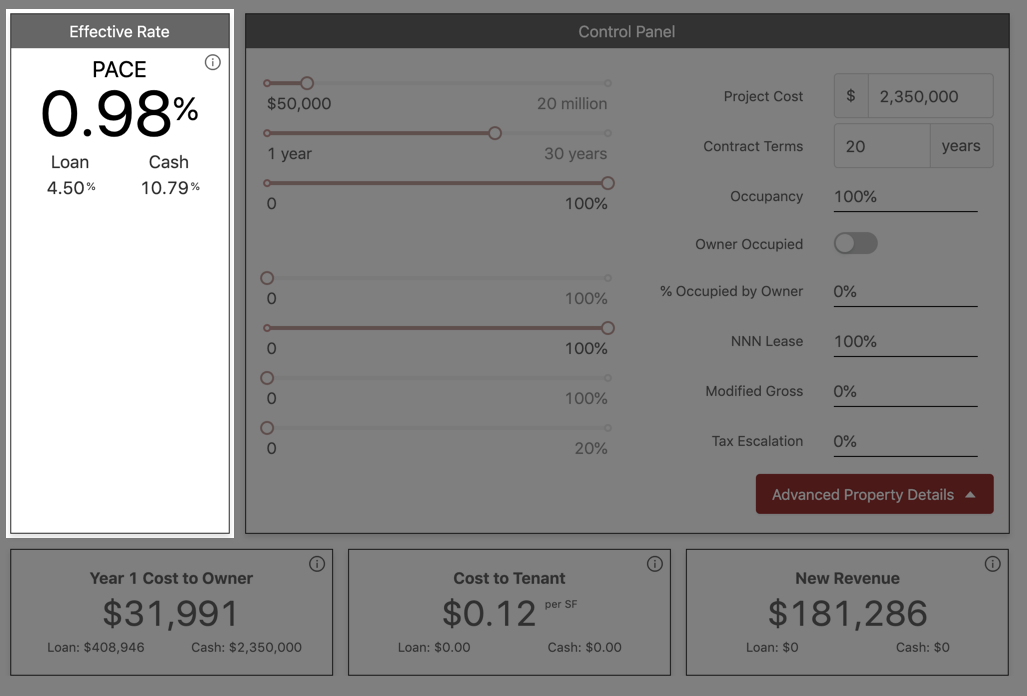

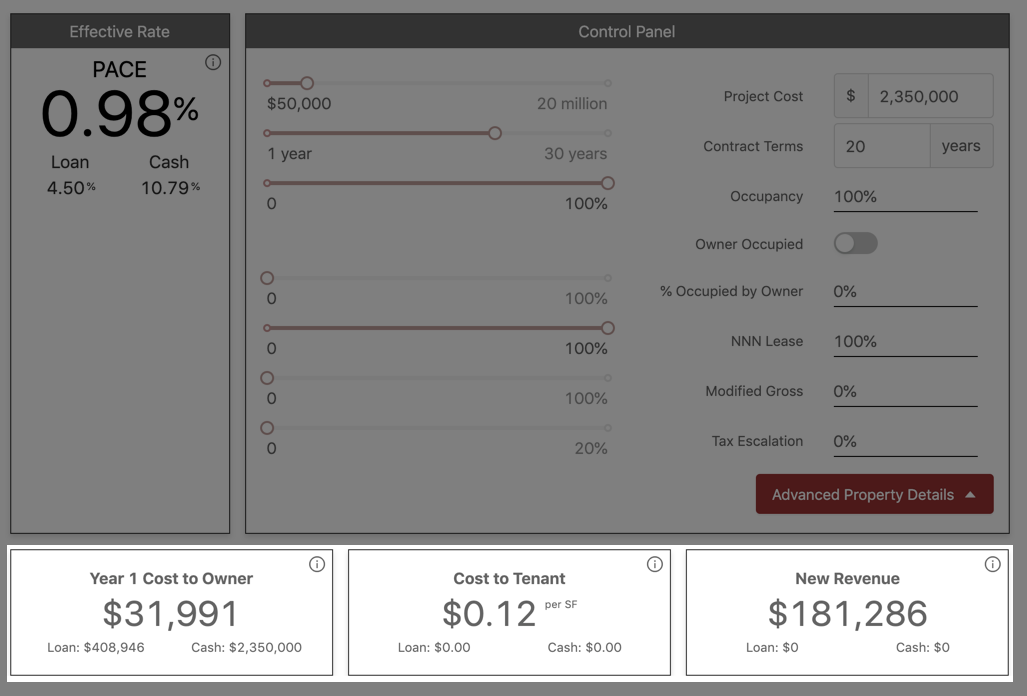

Tools for ESG ProfessionalsCash flow calculator

Tools for ESG ProfessionalsCash flow calculator

Adjust the controls to match the occupancy conditions of your building in order to get a more comprehensive forecast of the financial costs of benefits and financing.

Compare costs of capital. It's important to understand how to compare the costs since cash isn't free and some interest rates hide hidden charges.

Find out how much you can save or even profit by using certain types of financing. And, if you have tenants, how might they be impacted.

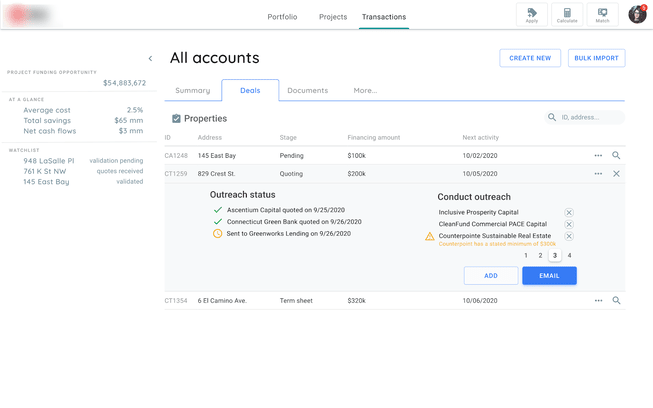

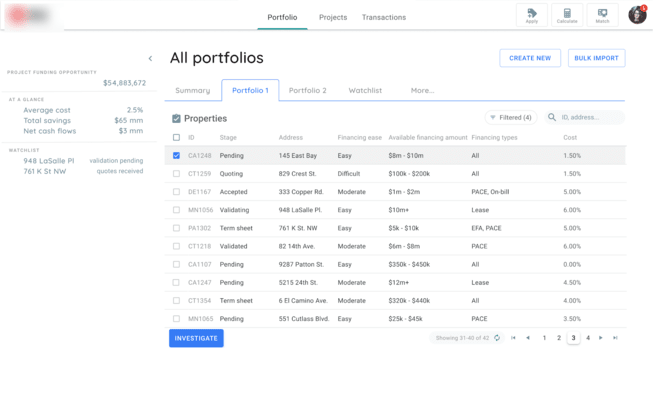

Tools for Enterprises Manage Portfolios

Tools for Enterprises Manage Portfolios

Instantly assess and score entire portfolios of buildings to identity bankability, credit, and utility savings potential, automatically identifying and prioritizing candidate properties for sustainability retrofits.

Tools for EnterprisesCoordinate Properties

Tools for EnterprisesCoordinate Properties

Collaborate between teams or companies working on the ground to verify project viability on candidate properties.

Work together to manage local decision makers’ expectations and close financings.

Tools for Enterprises Execute Transactions

Tools for EnterprisesExecute Transactions

Unety automates and democratizes brokerage of sustainability finance. Anyone can be their own broker and earn brokerage fees with the right tools and network. Existing brokers can dramatically improve productivity and performance with better tools and a larger network.